With the rising cost of living expenses and inflation, many Americans are living paycheck to paycheck. According to Fortune Magazine, 60% of United States consumers were living paycheck to paycheck just this past spring. Not only is this due to the high cost of living, but many Americans are currently financially burdened with debt such as student loans, credit cards, and medical expenses.

At ORNL Federal Credit Union, we understand that it can be stressful when living paycheck to paycheck. When you’re trying to make ends meet and are covering just your expenses—there is no room for unexpected costs or other financial obligations. However, there are ways to break out of the cycle of living paycheck to paycheck. Below are some examples of how it can be done!

Create That Budget

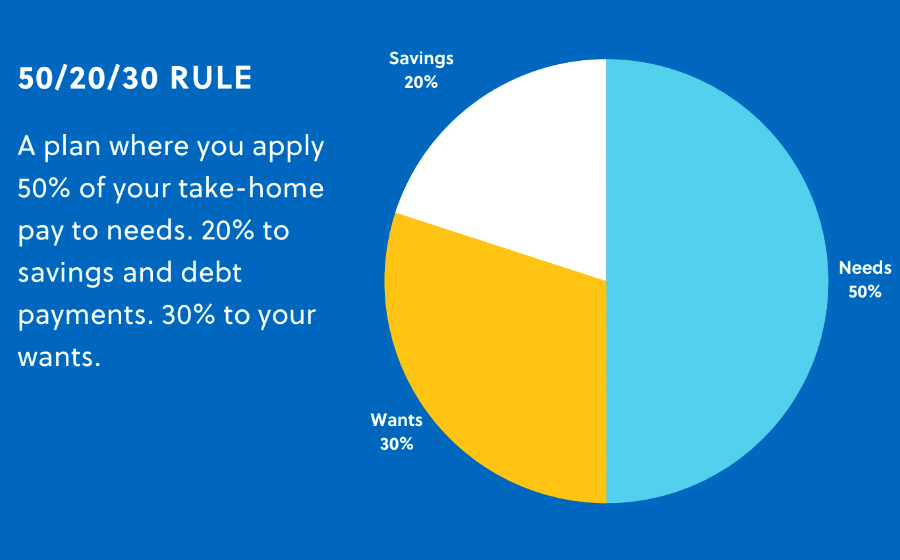

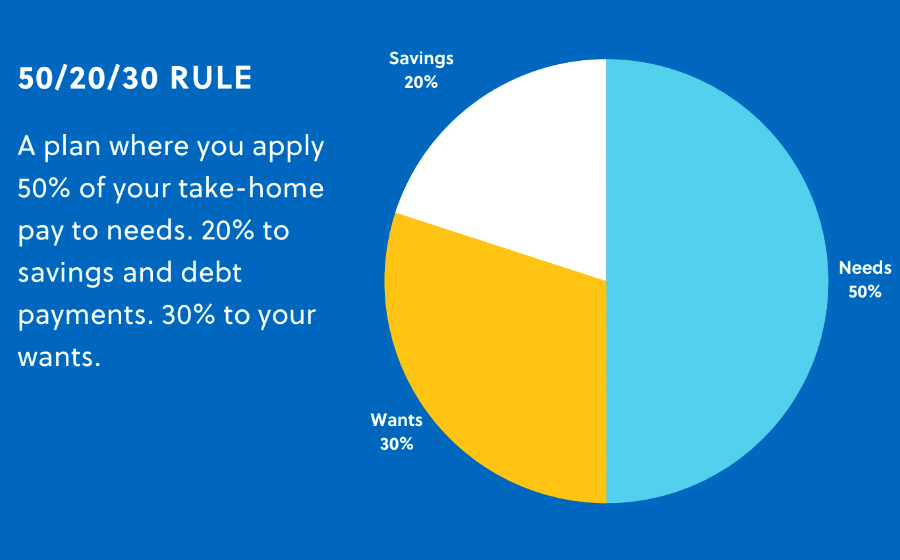

We know—creating a budget isn’t exactly the greatest time in the world. However, you will be proud of yourself for completing it and sticking with it in the long run. Take a look at your financial statements and see where your money is going each month. It might be time to cut back on items that aren’t a necessity. Not sure where to even begin when it comes to creating a budget? We recommend trying out the following methods: the 50, 20, 30 Rule or the Zero-Based Budget.

Create an Emergency Fund

If you don’t have an emergency fund, now is the time to create one! Ideally, your emergency fund is separate from your savings account. It should be used for unexpected medical bills, living expenses if you are laid off, and more. It’s recommended that you have at least three months of expenses saved up. However, we understand that might not be ideal if you are living paycheck to paycheck. So, just setting back some amount of money for your emergency fund can work—even if it is just $10 each paycheck. At ORNL FCU, we can even help you set up automatic savings transfers that reoccur each time you get paid. So, we do all the hard work for you!

Find Ways to Create More Income

While it might not be possible for your employer to give you a raise at this exact moment, there are ways to create more income. In fact, 2020 brought a surge in self-startups and small businesses due to the global pandemic. Maybe you have a hobby or craft that you can turn into a side hustle. Perhaps you can start a part time job on the weekends to help create some extra cash flow.

Say No to More Debt

It’s easy to get caught up in the snowball of borrowing more money when you are living paycheck to paycheck. However, you’re just digging yourself into a deeper financial hole. Remember, if you are living paycheck to paycheck, there is no room for any other financial obligations. Instead of opening more credit cards or quick pay loans, focus on paying off your current debt. Start with paying off the smaller balances or the ones with the lowest interest first.

A debt consolidation loan is always an option for those who are paying multiple debt payments with high interest rates. With a debt consolidation loan, you are able to roll those debts into one payment with the goal being a lower interest rate. At ORNL FCU, members can conveniently apply for debt consolidation and other types of loans through our online digital banking services or the mobile banking app.

At ORNL FCU, we want you to thrive in all aspects of your life. If you have any financial questions or are not sure where to start when it comes to finding the right financial institution, please contact us. We would be happy to help!