What features are changing?

If you use any of the following features, please review this important information:

ALERTS

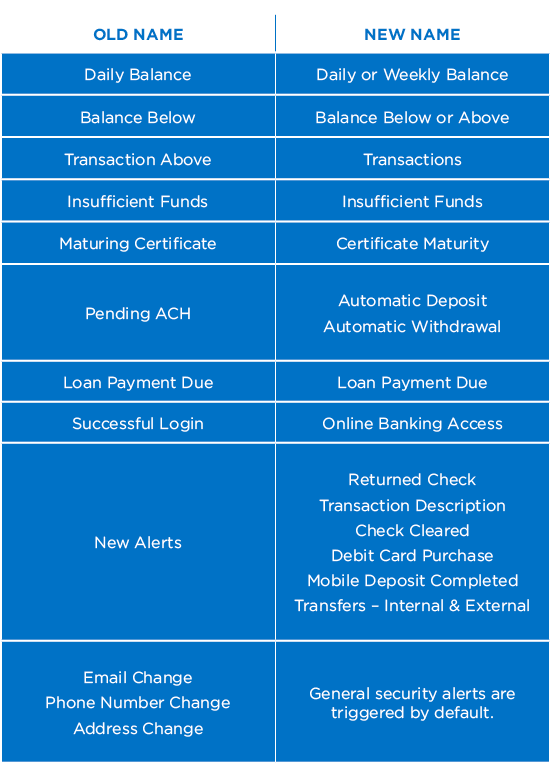

The new platform offers a brand new, more robust, alert system. Previously established alerts were stopped at midnight on May 10. You will need to re-establish your alerts on the new platform. Your previous selections will not transfer into the new system.

ADVANTAGES OF THE NEW ALERTS

The new alerts offer more options and flexibility.

BILL PAY

All of your payees, scheduled payments, and payment history are now available on the new platform. The new layout is streamlined to make it even easier to add and manage payees, make payments, and view payment history.

FOCUS MONEY MANAGER

Focus Money Manager will not be available in the new system, but you can take advantage of a number of features that will help you better manage your money.

You can link external accounts* from other financial institutions to view balances and transactions. You will need to reconnect any previously linked accounts, so be sure to have your usernames and passwords available for all of your financial institutions including your credit card, mortgage, and retirement accounts. In the mobile app, choose Link and View External Accounts at the bottom of the Accounts screen. In Online Banking, choose Link External Accounts on the Dashboard.

You can view and categorize your spending, create and monitor your savings goals, and even track and improve your credit score with the new services offered under Financial Wellness.

*Not all financial institutions participate. If you are not able to connect your external account and have verified that your username and password are correct, contact the other financial institution for assistance.

INTUIT'S QUICKEN, QUICKBOOKS, OR MINT

ORNL Federal Credit Union migrated to a new digital banking platform on May 10, 2022. This upgrade requires that you make changes to your QuickBooks or Quicken software, so please take action to ensure a smooth transition. Conversion instructions are available below.

1ST ACTION DATE: May 8, 2022

A data file backup and a final transaction download should be completed by this date. Services will go offline on May 9. Please make sure to complete the final download before this date since transaction history might not be available after the upgrade.

2ND ACTION DATE: May 11, 2022

This is the action date for the remaining steps on the conversion instructions. You will complete the deactivate/reactivate of your online banking connection to ensure that you get your current Quicken or QuickBooks accounts set up with the new connection.

CONVERSION INSTRUCTIONS

Quicken – click here (PDF)

QuickBooks Desktop – click here (PDF)

QuickBooks Online – click here (PDF)

Mint – click here (PDF)

Intuit aggregation services may be interrupted for up to 3–5 business days. Users are encouraged to download a QFX/QBO file during this outage.

THE FOLLOWING SERVICES MAY NOT WORK DURING THE OUTAGE:

· Quicken Win/Mac Express Web Connect

· QuickBooks Online Express Web Connect

· Mint

Please carefully review your downloaded transactions after completing the migration instructions to ensure no transactions were duplicated or missed on the register.

MOBILE APP REMEMBER ME FOR MULTIPLE ACCOUNTS

If you have multiple accounts and access them using the mobile app, please know that you will need your username and password each time you log into a different account.

We regret that the Remember Me for Multiple Accounts feature will not be available initially. We are working hard to bring this feature to users soon.

MOBILE WEB (ONLINE BANKING USING YOUR PHONE OR TABLET)

If you access Online Banking using your mobile phone or tablet, be sure to visit the mobile site for the best navigation experience. You can choose CLICK HERE FOR MOBILE SITE on the right side of the login screen or save this shortcut to your device: https://db.ornlfcu.com/Mobile/Authentication.

PAY A PERSON

Pay a Person (P2P) allows you to send funds directly to family and friends using a mobile phone number or email address. On the new platform, funds can be sent in two ways that are determined by the Transfer From account:

1) Debit Card. Funds can be sent in near real-time.

Scroll to the bottom of your account list to select a debit card. You'll see the last four digits of the card to confirm you are selecting the right one. If the recipient enters a debit card to receive the funds, the transfer occurs within minutes.

2) Share. Funds can be sent via ACH by selecting a share account. The transfer typically takes 1-2 business days.

Your payees will not transfer to the new platform and will need to be re-established. It's easy to add a new payee. Simply enter their name and email address or phone number and select Add Contact.

ADVANTAGES OF THE NEW PAY A PERSON SERVICE

In the new system you can edit or delete your payees. Recipients can also choose to have future payments from you sent automatically to their account with no need to log in or take any action.

RECURRING TRANSFERS

Digital Banking for Business

All new business platform with added features.

- Customize administration roles and access for each unique user.

- Gain critical business data and insights with enhanced reporting.

Download Admin Product Guide (PDF)